Blog

Things To Consider When Buying a Home

July 12, 2022

Are you thinking of buying a home this summer? If so, you have a great opportunity in front of you. Here are just a few reasons why this season may be the right time to make your purchase.

Are you thinking of buying a home this summer? If so, you have a great opportunity in front of you. Here are just a few reasons why this season may be the right time to make your purchase.

1. Homeownership Has Many Perks

Whether your needs have changed, you’re looking for more stability, or you’re ready to enter a new chapter in your life, turn to homeownership. It not only provides a safe space to call your own, but it also helps you build your net worth through home price appreciation and home equity. Not to mention, it gives you a sense of pride and accomplishment that carries through your day-to-day life.

2. Home Prices Are Climbing

So far this year, home prices have increased. While competitive buyers are expected to keep home prices climbing, industry leaders say the pace of the increases should moderate moving forward. As Len Kiefer, Deputy Chief Economist at Freddie Mac, says:

“If you’re thinking about waiting until next year and that maybe rates are higher, but you’ll get a deal on prices – well that’s risky. . . . It may be more advantageous to purchase this year relative to waiting until 2023 at this time.”

While everyone moves through the home buying process at a different pace, it’s more important than ever to put your plans in place and begin working with our home consultants.

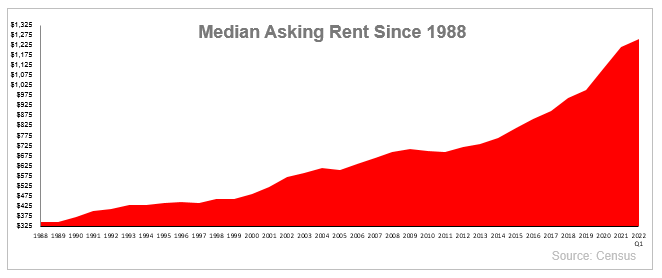

3. Rents Are Rising Too

Census data shows the median monthly rent is also going up. To escape rising rents, consider purchasing a home so you can lock in your monthly mortgage payment. Homeownership is a much more stable long-term investment.

While today’s housing market is competitive for buyers, it’s also a great window of opportunity. If you want to buy/build a home, here are a few things experts say you should know about what to expect and why homeownership is so important.

While today’s housing market is competitive for buyers, it’s also a great window of opportunity. If you want to buy/build a home, here are a few things experts say you should know about what to expect and why homeownership is so important.

The link between financial security and homeownership is undeniable. But your home also provides a sense of gratitude, pride, and comfort. Here are some of the best emotional and financial benefits that come with owning a home.

The link between financial security and homeownership is undeniable. But your home also provides a sense of gratitude, pride, and comfort. Here are some of the best emotional and financial benefits that come with owning a home.

The Emotional Benefits of Owning a Home Are Powerful

In their list of top reasons to buy a home, the National Association of Realtors (NAR) highlights some of the powerful, non-financial aspects of homeownership. Among them is the opportunity to customize your home to reflect your personality and needs:

“The home is yours. You can decorate any way you want and choose the types of upgrades and new amenities that appeal to your lifestyle.”

Another benefit homeowners enjoy is the stability it provides. Homeowners typically stay put longer than renters. According to NAR, when you remain in one place for more than a few years, you can grow closer to your community, which can enhance your sense of pride and lead to better relationships.

Owning a Home Is a Building Block for Financial Success

The benefits of homeownership extend beyond the emotional too. Owning your home is a cornerstone of achieving financial success. As Leslie Rouda Smith, President of

NAR, says:

“Homeownership is rewarding in so many ways and can serve as a vital component in achieving financial stability."

But many people may not realize just how much owning a home contributes to their net worth. A recent NAR report details several homeownership trends and statistics, including the difference in net worth between homeowners and renters. It finds:

“. . . the net worth of a homeowner was about $300,000 while that of a renter’s was $8,000 in 2021.”

To put that into perspective, the average homeowner’s net worth is roughly 40X that of a renter. The gap in net worth exists because as a homeowner, you gain equity as your home appreciates in value and as you pay your mortgage each month. As a renter, you’ll never see a return on the money you pay out in rent every month.

If you’re thinking of buying a home this season, the biggest opportunity you have right now is to get ahead of rising housing costs. Here’s what you need to know.

If you’re thinking of buying a home this season, the biggest opportunity you have right now is to get ahead of rising housing costs. Here’s what you need to know.

What’s Happening To Mortgage Rates This Year?

While it’s true the 30-year fixed mortgage rate has climbed over two percentage points this year, just remember that perspective is key. Even though mortgage rates are higher now than they were during the pandemic, they’re still more competitive than historic norms. Mark Fleming, Chief Economist at First American, explains:

“Rising mortgage rates impact affordability, but historical context is important. An average 30-year, fixed mortgage rate of 5.5 percent is still well below the historical average of nearly 8 percent.”

The graph below further illustrates this point. Today you can still lock in a rate that’s comparatively lower than decades past.

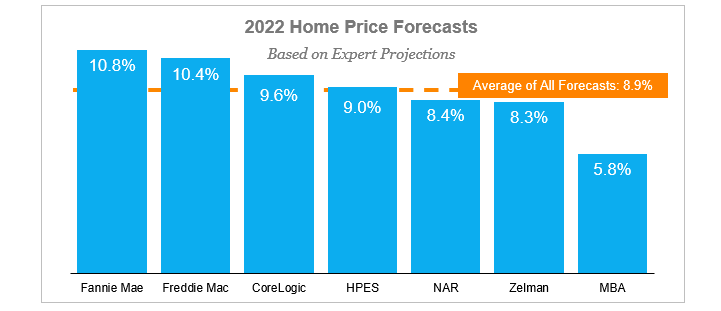

What Will Happen With Home Prices This Year?

In addition, home prices are expected to continue appreciating. The graph below shows the 2022 home price forecasts from seven industry leaders. As the bars indicate, they’re all projecting an increase this year as buyers competing for a limited number of houses continue to put upward pressure on prices. The dotted line represents the average of all the forecasts together, showing the rate of appreciation is expected to be about 8.9%.

While that’s not the record-breaking increase we saw over the past year, its still continued price growth – not a decline. Why is that important to you? If you’re waiting for prices to drop because you think homes will be more affordable, the data from leading experts simply doesn’t support it.

If you’re following the news today, you’re probably hearing about increasing home prices, rising consumer costs, and more. These inflationary concerns might make you wonder if you should wait to buy. Here’s why inflation shouldn’t stop you from purchasing a home this season.

If you’re following the news today, you’re probably hearing about increasing home prices, rising consumer costs, and more. These inflationary concerns might make you wonder if you should wait to buy. Here’s why inflation shouldn’t stop you from purchasing a home this season.

Homeownership Offers Stability and Security

Investopedia explains that during a period of high inflation, prices rise across the board. That’s true for things like food, entertainment, and other goods and services – even housing. Both rental prices and home prices are on the rise. So as a buyer, how can you protect yourself from increasing costs? The answer lies in homeownership.

Buying a home allows you to stabilize what’s typically your biggest monthly expense: your housing cost.

If you get a fixed-rate mortgage on your home, you lock in your monthly payment for the duration of your loan, often 15 to 30 years. James Royal, Senior Investing and Wealth Management Reporter at Bankrate, says:

“A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. Sure, property taxes will rise and other expenses may creep up, but your monthly housing payment remains the same.”

So even if other prices rise, your housing payment will be a reliable amount that can help keep your budget in check. If you rent, you don’t have that same benefit, and you won’t be protected from rising housing costs.

Use Home Price Appreciation To Your Benefit

While it’s true rising home prices mean buying a house today costs more than it did a year ago, you still have an opportunity to set yourself up for a long-term win by locking your payment in at today’s rates and prices.

During inflationary times, it’s especially important to invest your money in an asset that

will hold or grow in value. The graph below shows how home price appreciation outperformed inflation in most decades going all the way back to the 1970s:

So, what does that mean for you? Once you buy a house, any price appreciation

that does occur will be good for your equity and your net worth. And since homes are typically assets that grow in value, you have peace of mind that history shows an investment in homeownership is a strong one.

The Bluffs questions contact:

Kate DaSilva 910-742-5736 or kate@kenthomes.net

St. James or Scattered Site questions contact:

Carol Hobbs 910-619-0777 or carol@kenthomes.net

Brunswick Forest / Compass Pointe questions contact:

Kayla Paladino 910-599-6739 or kayla@kenthomes.net

Latest Posts

April 25, 2025

Vote for People’s Choice at the 2025 Parade of Homes!

April 17, 2025

Tour 4 Stunning Kent Homes in the 2025 Wilmington Parade of Homes

April 13, 2025

Flooring Tips for Coastal Living: Kent Homes Featured on Redfin!

April 7, 2025

Live Like You're on Vacation Every Day in Brunswick Forest

March 21, 2025

Celebrating Our Homeowners: Kent Homes' Appreciation Event at Compass Pointe

March 18, 2025

Introducing the Kent Homes Referral Program: Share the Love, Earn Rewards

March 17, 2025

Spring Into Your New Home with a $10k Move-In Incentive

March 11, 2025

Price Certainty: Your Home, Your Investment, Our Commitment

March 8, 2025

Luxury Living Meets Natural Beauty: Build Your Dream Home at The Bluffs

Previous Article

Perspective Is Important

Next Article